26 nov 2025

Follow these seven essential steps to be sure you claim all the small business tax deductions you’re entitled to.

Having everything in good order is key. You need to keep all records that prove your business and personal deductions. Checks, invoices, medical bills, bank statements, mortgage records, and other essential documents should be kept for three years minimum.

It’s completely up to you how exactly you organize this information. It can be specialized software or simply spreadsheets in Excel. But for your convenience, it’s helpful to separate your business and personal records. And we’ll tell you why soon.

As for storing documents, the IRS doesn’t demand that you keep all of them in paper. It’s perfectly fine to have digital copies as long as they are accurate, readable, and easy to access.

One easy option is to use a mobile app like iScanner. It allows you to scan your papers straight away, whether you’re in your office, in a warehouse, or even behind the wheel. Apart from scanning, you can:

Here’s how to use iScanner in four simple steps:

“To be deductible, a business expense must be both ordinary and necessary,” states the IRS website.

Sounds a little bit vague. Let’s break it down:

To sum it up, an expense should be typical for your type of work and useful for your business, but it doesn’t need to be absolutely essential.

The formula is quite simple. Your net business income is your business’s total income minus its business expenses.

However, there are a few peculiarities about whether you should count the net business yourself, depending on your business structure.

Owners of sole proprietorships or single-member LLCs should calculate it themselves because business expenses flow directly onto their personal tax return and reduce net income.

As far as partnerships, S corporations, and C corporations are concerned, the business calculates its net income first, so owners don’t personally subtract business expenses (which doesn’t mean they don’t benefit from it).

Personal tax returns must be filed by everyone, no matter what type of business you own.

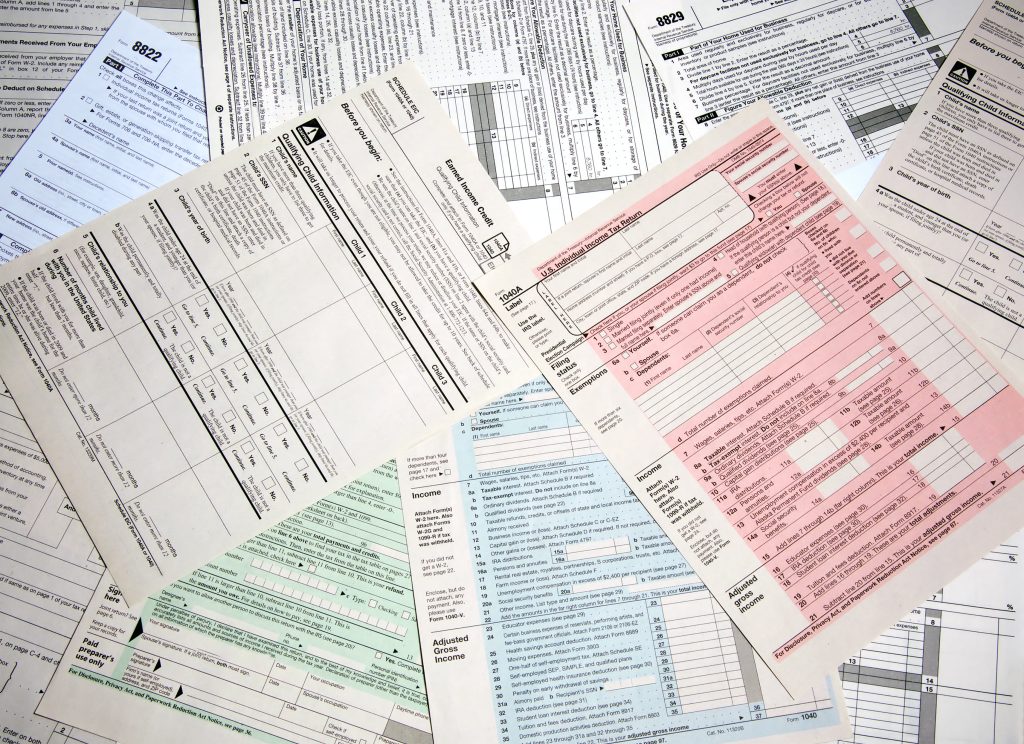

There are two options available:

A standard deduction is a fixed amount of money. The exact figure depends on several factors. These are your filing status (single/married jointly/married separately/head of household, etc.), your age, and whether you’re legally blind or not. You can estimate the exact amount of money with the help of an interactive tax assistant on the IRS website.

Some people can choose to itemize (make a list of) deductions when that list saves them more money than the standard deduction. These include:

However, there are some exceptions as well. Certain taxpayers can’t take the standard deduction. For instance:

NB! Don’t confuse personal deductions with business ones. Business deductions reduce your business income before your personal deductions apply.

The forms dictate how deductions are reported.

Sole proprietors and single-member LLCs: Use Form 1040 with Schedule C attached.

Partnership/multi-member LLCs: File Form 1065 with a Schedule K-1 for each partner.

S-Corporations: Use Form 1120-S with a Schedule K-1.

C-Corporation: File Form 1120.

Double-check everything and submit before the deadline.

Check out these helpful guides for some extra support: