15 feb 2023

Every year, the “most wonderful season of all” is followed by the least favorite season of all: the tax season. However, there are some simple steps you can take to make it as stress-free as it can possibly be. If the thought of tax forms and a pile of receipts in your desk drawer gives you a slight feeling of nausea and a twitchy eye, keep reading. We’re going to look into some tax tips to make filing taxes easier.

Most taxpayers in the US have until April 18 to file their returns this year. However, the earlier you start, the less stressful the process might be, especially if you have a complicated tax situation.

Staying informed about tax law changes is crucial for effective tax planning. Tax law and eligibility rules for tax credits change from year to year. It’s a good idea to keep an eye on the official IRS website to stay up-to-date and avoid unpleasant surprises.

According to official statistics, 55% of American taxpayers used professional help when filing their tax returns last year. However, even the best tax preparer won’t collect and organize your tax records for you. The IRS says organizing your receipts and tax records is one of the best tips to make filing taxes easier (and who better to ask than them).

Dealing with receipts can be a lot of hassle, though. The good news is that the IRS doesn’t require you to provide or keep the original hard copies of your receipts for deductible expenses. They are perfectly happy with digital copies as long as they are:

This means that (1) you no longer need to keep a mound of receipts, and (2) you will need a reliable digital tool to create an IRS-friendly digital cabinet. Luckily, there are plenty of solutions to do exactly that.

If you’re feeling particularly lazy looking at the paper pile in front of you, you can employ the help of professional receipt organizers like Shoeboxed. They allow you to stuff all your paper receipts into an envelope and post the whole bunch to them. They will then digitize and arrange them into categories for you for only $18 a month. For that money, they will even provide an envelope free of charge. They also use OCR so that the data on the images becomes searchable.

On the other hand, if sending your receipts to a third party makes you feel uneasy, or you just don’t want to pay $18 a month, you can use iScanner all year round on an unlimited number of your devices. This app will help you prevent the receipt pile from occurring in the first place. iScanner is excellent for digitizing any kind of document, even if you’re on the go, because it uses AI to detect the document edges and remove shadows and creases. You can snap a picture of the receipt on the spot and dispose of it right away.

Also, with a solid scanner, you can be sure that the quality of your digital receipts will be up to scratch every time.

The app has a handy file management system that lets you organize your documents into folders and search through your files. Cloud Sync is also a huge benefit: not only does it back up your files in the cloud, but all the changes and new documents are synchronized in real time on all your devices.

Certified public accountants name creating a dedicated digital folder for all your tax forms as one the best tips to make filing taxes easier. It will make the filing process a lot less stressful regardless of whether you use professional help or not.

As a lot of people nowadays use mobile devices to manage their documents, it’s worth keeping in mind that using a dedicated app for important documents can save you a huge amount of time and stress. It will take only a second to save a tax form from your email to a dedicated folder once you receive it but make it so much easier to find the form when it’s time to file.

The iScanner app can be of great help with this for several reasons:

Tax forms contain a lot of sensitive personal information, such as your social security number, address, yearly income, etc. Therefore, the software or mobile apps you use to manage or keep them should have superb cybersecurity and a data protection system. Checking who the developers are and where they are located would not be overkill. It’s also highly recommended to add another layer of security by protecting the documents and folders with a password or FaceID.

If you’re expecting a tax refund and are keen on getting it sooner, the best practice is to file your return electronically. According to the IRS, only 8% of filers decided to stick to an old-fashioned paper filing last year. The vast majority of Americans chose to e-file for a good reason. Based on experience, e-filing is easier and faster and reduces the risk of errors. Also if you file electronically, you’ll be able to track the status of your return.

Another important thing to consider is that the timeline for your refund will be significantly longer if you apply for a refund check in the mail. For instance, those who file with direct deposit can expect their refund within 21 days while those who file for a refund check will have to wait up to eight weeks.

One of the best tips that can make filing taxes a great deal easier is to take advantage of modern software and mobile apps.

Free File can be immensely helpful as it offers guided tax preparation and filing. The software will guide you through the whole process, calculate your return, and help you claim all eligible deductions and credits free of charge. It also provides live chat support. Taxpayers who earn $73,000 per year or less may be eligible for Free File. To see if you qualify, visit the IRS website.

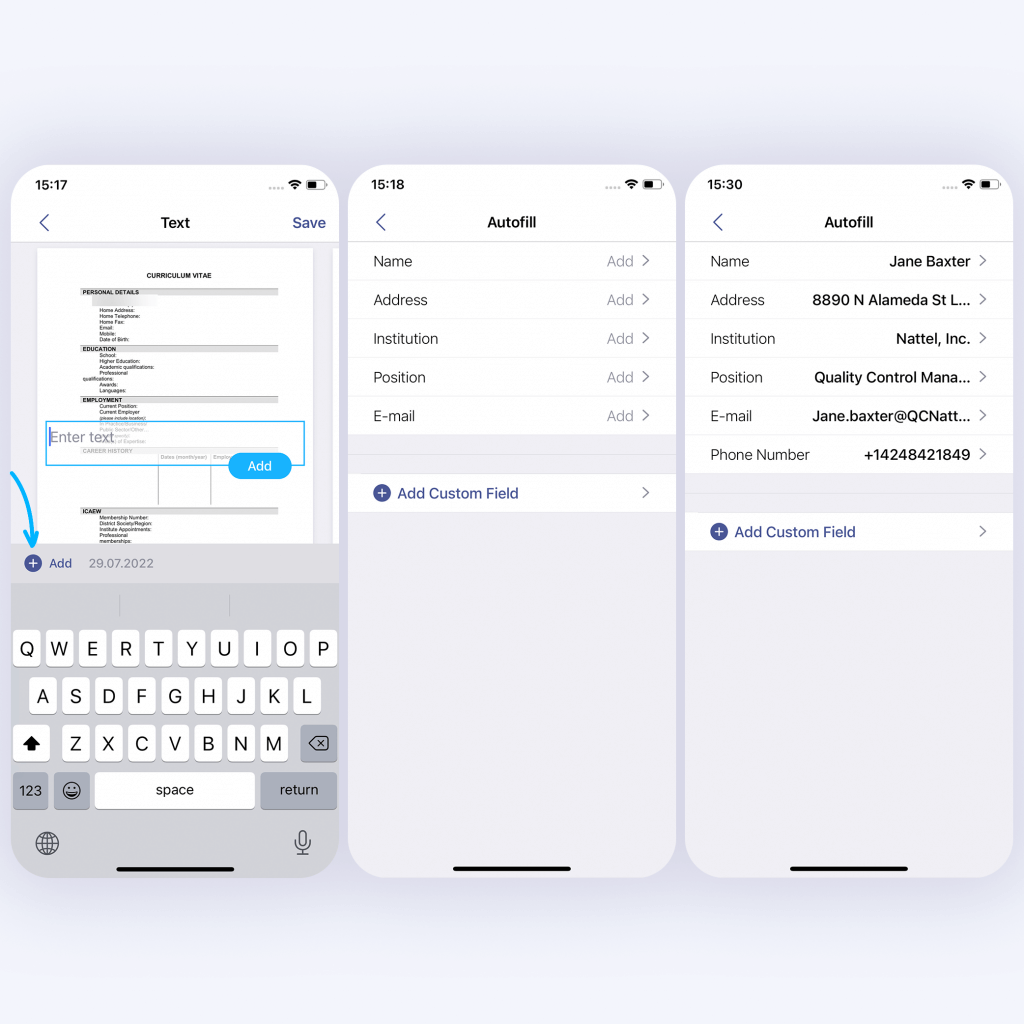

The number and type of tax forms that you need to fill out depend on your tax situation. But regardless of the form, your personal information remains the same.

This means that using an autofill feature can save time and effort and prevent typos. In the iScanner app, for example, you can add any frequently used info, such as your first and last name, date of birth, address, social security number, email, etc.

To do that, hit the +Add button within the Text menu, populate the pre-saved fields, and add any number of custom fields. Once you add this info, you can simply paste all the details by tapping the respective categories as shown below.