08 jan 2024

Have you been asking yourself, when preparing your taxes, what can possibly help reduce the amount of taxes that you owe? The answer? Tax deductions and tax credits! According to some CPAs, millions of taxpayers in the US overpay thousands of dollars every year simply because they fail to identify which of their expenses qualify as tax deductions. In this post, we’ll tell you about the most overlooked deductible expenses that can help you save big time on your income tax. We’ll also tell you how a simple PDF scanner app can help you be well-prepared for an IRS audit.

Reducing your tax burden might sound tempting, but what exactly should you do to make it work for you and avoid trouble with the IRS in case of an audit? There are only three things you need to do. Yes, it’s actually quite simple.

An important thing to keep in mind is that if you file jointly with your spouse, you both have to choose the same deduction method.

An IRS audit can be stressful, but the good news is it doesn’t have to be. You can take a great deal of pressure off by simply keeping the necessary documentation organized. So what kind of documents do you need to sustain your claims and keep the IRS happy?

Of course, it can be annoying to collect a year’s worth of receipts, but the IRS doesn’t require you to show up on their doorstep with a shoebox. A scan is perfectly fine as long as it’s of sufficient quality, complete, and unaltered.

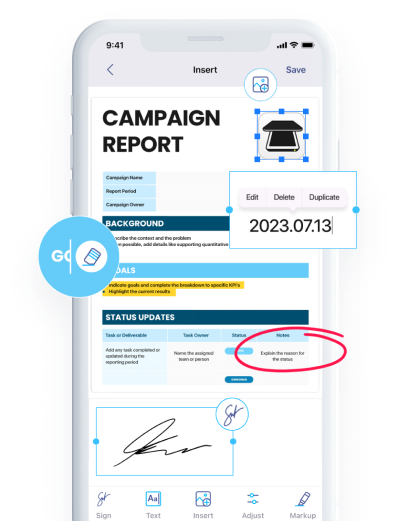

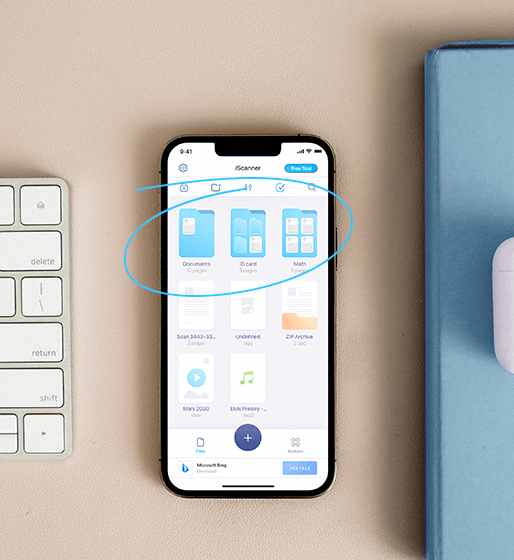

The best solution is to install a mobile scanner app and adopt the habit of scanning receipts for taxes so that everything is in one place and readily available. iScanner is one of the few solutions that are IRS-friendly because it allows you to:

Now, let’s look into the actual deductions that a lot of people often overlook and fail to report. In case you’re unsure what tax deductions are, they are expenses that you can subtract from your taxable income, resulting in you paying less in tax.

If you donate to charity, you might be glad to know that it can reduce your tax burden by a lot if you choose to itemize! Plus, not only money can be reported as a tax deduction but pretty much anything you donate. This includes clothes and all sorts of equipment like laptops, cameras, printer scanners, vehicles, and more. The only thing to keep in mind is that the IRS requires you to back up the reported price of expensive items with a receipt, so be sure to scan the receipts for taxes.

Saving for retirement is a smart move, and it can also lower your tax burden via a deduction or by putting you in a lower tax bracket. This covers both 401K plans and your individual retirement arrangements—everything you set aside for retirement can be deducted from your income! There’s a limit on how much you can deduct per year, though. For 2023, it’s $6,500, and $7,500 if you’re over 50.

If you made a large purchase this year or paid a mortgage, going for the itemized deduction might be beneficial. For cars, boats, and other expensive items on which you pay sales or property tax, you can report the amount you paid in tax as a deduction. With homes, you can write off mortgage insurance and mortgage payments you paid this year.

Education expenses can also reduce your tax burden. You can include all sorts of expenses like tuition fees, textbooks, rent, and even transportation costs to and from school! They also don’t have to be your personal expenses—dependents qualify too. So if your kid went to college in another city, make sure they install a mobile scanner to scan receipts and organize them for taxes.

There’s no doubt about it—medical bills can be heavy. But the good news is that you can report them as tax deductions if they constitute more than 7.5% of your income. All sorts of medical procedures, medications, and related expenses can qualify as tax deductions—from artificial teeth to acupuncture to medical equipment installed in your home (you can see the official IRS list for 2023 via this link). What’s more, it doesn’t have to be your personal medical bills—spouses, dependants, and relatives qualify too (that’s to say, if you paid their medical bills out of pocket).

If you set aside some money for potential medical expenses, good for you! And it’s tax deductible—everything you set aside for this purpose lowers your taxable income. There are limits, though, that change every year. Check them on the IRS website.

Tax credits are deductions on steroids—they reduce your tax bill directly (not your taxable income). What’s more, with some tax credits, you might find that the IRS owes you—if a credit reduces your tax bill to below zero, you get a refund! Also, you might be glad to know that in some cases, you can claim both deductions and credits for the same type of expenses. For example, education-related expenses are deductible, but you or your dependent may also be eligible for education tax credits—don’t hesitate to check this page on the IRS website for more details.

If you’ve installed solar, wind, or geothermal energy systems in your home, you get tax credits that will cover roughly a third (as of January 2024) of the installation and other related costs! By the way, this covers energy-efficient doors and windows too. So, for example, if you paid $2,000 for solar panels, you’ll get $500 in tax credits. If you owe $1,500 in tax, you’ll only pay $1,000 because the rest will be covered by your tax credit. You can check how it works in more detail here.

Here’s a riddle: an accountant has two children, what are their names? Answer: Dependent #1 and Dependent #2. Now, if you’re a parent, you very likely know this, but just in case you don’t, you get $2,000 in tax credit for every child you declare as a dependent. This amount is subtracted directly from the amount you owe in tax. You can check the eligibility criteria on the IRS website. By the way, a dependent doesn’t have to be your biological child—siblings, cousins, stepchildren, grandchildren, nieces, and nephews count as well as long as you provide for them and no one else reports them as dependents. There are other related tax credits, such as child care credit and education credit, so be sure to check if you’re eligible on the IRS website.

Scanning receipts with your phone is even easier than taking a photo!

A few IRS-friendly tips for scanning receipts:

Ideally, you save them to a dedicated folder. That’s of course in a perfect world where no one is ever in a hurry or forgets a thing. For those who live in the real world, iScanner has a safety net: the Content Search feature that allows you to find any file by a keyword even if you don’t remember where or when you scanned it. It’s also worth noting that searchability is one of the IRS requirements for digital repositories. So, if you’ve been looking for the best way to organize receipts for taxes, we say just scan them with iScanner and the app will do the rest.

We hope this makes the tax season somewhat easier for you and helps you save some of your hard-earned money. Keep calm, scan receipts for taxes, and remember: plenty of things are deductible, and for those that are taxing, the IRS might give you credit!

The information provided in this blog post does not, and is not intended to, constitute legal advice.